By Liu Mengmeng and Shaw Wan

BEIJING, February 21 (TMTPOST)— ByteDance’s Douyin, the Chinese version of the short video app TikTok, is testing food delivery services in several Chinese cities, with a plan to expand business to the rest of China. Although the official launch date of the national plan is yet to be announced, there has been heated discussions about the company taking on Chinese food delivery giant Meituan and Alibaba-backed Ele.me in the multibillion-dollar sector.

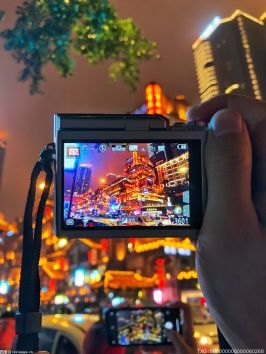

Image Source : China Visual

(资料图片)

(资料图片)

First Impressions

“We can order takeouts while enjoying the trending videos,” a Douyin user told TMTPost. Consumers in three megacities -- Beijing, Shanghai and Chengdu -- can now enjoy the food delivery trials offered by Douyin. What they were most concerned about were the delivery time and the price. To get firsthand experience, TMTPost gave it a try the other day.

The service is called “group-purchased goods delivery,” which can’t be directly accessed on the app’s home page. The “nearby restaurants” button on the subpage named “in the same city” or search the keywords needs to be clicked in order to get it started.

Although the catering companies on Douyin covered multiple categories such as snacks, fast food, barbecue, hot pot, desserts and soft drinks, not all of them provided delivery services. For example, among the 20 companies on the first page, only nine of them could deliver takeouts. When the options were narrowed down to restaurants that were within one kilometer and could offer delivery services, Douyin only gave eight choices, far fewer than the 19 ones available on Meituan and 17 on Ele.me. This was probably because such services were still at the pilot stage.

The number of items available on the menu for takeouts was also limited. Most of them were sold in combo meals. The few occasions that an order could be only made were in several patisseries. Because of the combos, prices for each order on Douyin were also higher than other platforms. Discounts were also available, ranging from a 20 percent to 60 percent off.

As for delivery fee and delivery time, not many differences were found among the three platforms. However, one thing to be noted is that Douyin might switch the restaurant chosen by a customer to a nearby one under the same brand. The delivery service was provided by the logistics giant SF Express, which is famous for quality and punctual delivery services across the country. “It is only recently that I have started to find food delivery orders on Douyin,” a delivery man from SF Express said.

Douyin users could also enjoy food delivery services via the mini program of Ele.me, as the two platforms have established a partnership.

Three Years into Food Delivery Service

Douyin eyed expanding into the food delivery sector three years ago.

In March 2020, Douyin launched a group buying function, encouraging customers to either visit offline stores or have their meals delivered to their doorstep. That was the first time for the video sharing platform to get involved in food delivery services. However, such move didn’t shake up the sector as the company wasn’t cooperating with merchants directly. It was more like an aggregator, offering Douyin users another way to use food delivery services provided by Meituan and Ele.me.

The company itself entered the food delivery market in July 2021 by testing a mini program named Xindong Waimai, which literally meant Exciting Food Delivery. About 300 merchants from major cities like Beijing and Shanghai joined the testing project. Due to the difficulties of building a logistics and delivery system and a lack of interest among merchants, the project didn’t make it to an official launch.

However, one year later, restaurant owners across China flocked into Douyin to livestream their meals with the hope of increasing sales, when the Covid-19 pandemic in early 2022 led to a ban on restaurant dining in many cities. They also offered self-delivery services. The company took the chance to customize a food delivery mini program for the merchants, which could dispatch orders automatically to delivery riders when consumers ordered takeouts while watching livestreams. The number of catering merchants that were broadcasting on Douyin in Beijing increased by 20 percent in May, when compared with that in April. Up to 1,000 orders were placed for popular dishes such as crayfish after a live broadcast.

Riding such wave, Douyin launched a “group-purchased goods delivery” service on the homepages of some restaurants in July 2022. With a simple click, consumers were able to place their orders after filling in their addresses. No third-party mini programs were needed in the process. Last August, Douyin reached a cooperative relationship with Ele.me to take advantage of millions of the latter’s catering service providers and delivery riders. Four months later, the company rolled out the feature to more markets across the country. It also enhanced its food delivery services by cooperating with more third-party intra-city express service providers like SF Intra-City, FlashEx and Dada Express. More catering service providers, in addition to those that sold fresh fruits and vegetables, were included in the pilot program in January 2023.

A Head-to-head Fight

The market scale of the Chinese food delivery sector reached 1 trillion yuan in 2021, of which Meituan and Ele.me accounted for over 90 percent, according to the State Information Center. If Douyin continued expansion, it could be a powerful challenger in the duopoly.

A head-to-head fight awaits Meituan, as Douyin tries to expand into its key sector after taking a share of its offline consumption and tourism, two of Meituan’s most profitable businesses. The company’s stock price plunged by over 9 percent one day after Douyin was reported to get a slice of the food delivery cake on Feb. 7. It slumped to 148.1 Hong Kong dollars on Feb. 10, a decline of 10 percent within three days.

Douyin’s share in the food delivery market may be higher than expected, the securities brokerage company Zheshang Securities anticipated. By aggregating food delivery services from third parties, the company managed to save costs. As deserts and snacks accounted for 14 percent of the gross merchandise volume of the food delivery market, the company would be able to make profits by promoting such livestreams.

SPDB International, an offshore investment bank, however, believed that Douyin’s expansion would have little impact on Meituan. “In recent years, Douyin has continued to invest in its local life services. On August 19, 2022, Douyin and Ele.me announced a cooperation relationship in this sector. But it didn’t affect Meituan much. I believe Douyin is more suitable for brand promotion with its huge traffic,” a person from SPDB International said.

Despite the trials in several major cities, Douyin hasn’t drafted a timetable for future expansion in food delivery services. Challenges like the limited number of merchants and the high prices for each customer need to be solved before an official national launch.

To attract more merchants, the key is to lower the commission. “It depends on how much commission they [Douyin] charge,” a restaurant owner that was weighing to cooperate with Douyin told TMTPost. The company takes about 2 to 10 percent from each order that comes via the app. For catering service providers, that number is 2.5 percent, far lower than the 25 percent that Meituan charges. Douyin might charge more in the future, as it could be the company’s tactic to draw merchants in the early stage.

As for the high prices for customers, Douyin may need to build its own delivery system since the third-party delivery companies can’t reach a certain scale.

Their rival Meituan has been aware of Douyin’s ambition.

Meituan started to cooperate with Douyin’s domestic competitor Kuaishou, another short video app, in December 2021. Livestreaming services became available to Meituan merchants in April 2022. A WeChat mini program was also launched last December to encourage content creators recommend Meituan merchants to the giant number of users on WeChat, China’s most popular messaging app with one billion monthly active users as of 2022.

The food delivery giant also began to compete for talents earlier this year. In the first quarter, the company planned to recruit 10,000 experienced professionals in the sector of local services, including food delivery, offline consumption and hotels. The demand for customer service and sales talents accounted for about 70 percent of the overall headcounts.

China’s food delivery market was forcasted to exceed942 billion yuanin 2022, making China the world’s biggest online to offline (O2O) food delivery market.Revenue in this sector was estimated to reach 354 billion dollars in 2023, with an annual growth rate of 10 percent in next four years, according to the data company Statista.

Behind the battle in this market stood the three tech giants, Tencent, Alibaba and ByteDance, which own Meituan, Ele.me and Douyin respectively. The longtime rivals have been competing against each other across industries for years.